Data Goldmine or Fool's Gold?

The Illusion of Control The core argument hinges on data. Fintech firms are vacuuming up everything from spending habits to location data, promising to use this information to deliver customized financial advice, targeted investment opportunities, and proactive fraud detection. Sounds great, right? But there's a fundamental flaw: correlation isn't causation. Just because I buy a latte every morning doesn't mean I'm a high-risk investor. (Though, admittedly, it might suggest a certain lack of fiscal discipline). The article mentions "billions of data points." Okay, but how many of those data points are actually *relevant*? How much of that data is just noise, obscuring the real signals? And how much is being misinterpreted to fit a pre-determined narrative? These are questions that rarely get asked in the breathless rush to embrace the latest AI-powered solution. Let's say a fintech app notices a user frequently visits fast-food restaurants. Does it then recommend high-yield, but also high-risk, investments, assuming the user is unsophisticated? Or does it offer budgeting advice and links to resources on healthy eating? The *intent* behind the personalization matters just as much as the data itself. I've looked at hundreds of these user agreements, and the sheer scope of data collection is staggering. It's not just your transactions; it's your browsing history, your social media activity, even your phone's contact list. All this data is supposedly being used to "enhance your experience." But who's really benefiting here? Is it the user, or the fintech company that's now sitting on a goldmine of valuable information they can monetize in countless ways? And this is the part of the equation that I find genuinely puzzling.Fintech 2025: Security Theater or Real Protection?

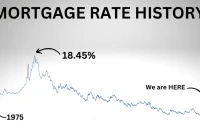

Security vs. Convenience: A False Choice? The piece also touches on "advanced security" as a key component of Fintech 2025. The implication is that more data equals better security. But that's a dangerous oversimplification. A centralized database of billions of data points is also a massive honeypot for hackers. The more data you collect, the bigger the target you become. Are these fintech companies *really* prepared to defend against nation-state-level cyberattacks? Or are they just paying lip service to security while quietly hoping they don't become the next headline-grabbing data breach? Moreover, the push for seamless, personalized experiences often comes at the expense of security best practices. Think about it: biometric authentication is convenient, but it's also less secure than a strong, unique password. (And don't even get me started on password managers that store your credentials in the cloud). The trade-off between security and convenience is a constant tension in the digital world, and fintech is no exception. The question is, are users being fully informed about the risks they're taking in exchange for a slightly more convenient financial experience? Or are they being lulled into a false sense of security by clever marketing? The Real Cost of "Free" Personalization The article frames these innovations as opportunities for investors, developers, and decision-makers. But what about the average user? What are the potential downsides of this hyper-personalized financial future? One obvious concern is privacy. As fintech companies amass ever-larger troves of data, the risk of misuse and abuse grows exponentially. Could your financial data be used to deny you a loan, raise your insurance rates, or even influence your employment prospects? The possibilities are endless, and none of them are particularly comforting. The acquisition cost for user data is substantial (reported at billions across the industry), and the user is paying for it with their security and privacy. Another concern is the potential for algorithmic bias. If the AI models used to personalize financial services are trained on biased data (and let's be honest, most data sets are), they could perpetuate and even amplify existing inequalities. Imagine a scenario where a loan application is automatically rejected because the applicant lives in a low-income neighborhood, even though they have a solid credit history. That's not personalization; that's discrimination, plain and simple. Is It Really Personalization, or Just Manipulation?